Electronic Payment System Solution

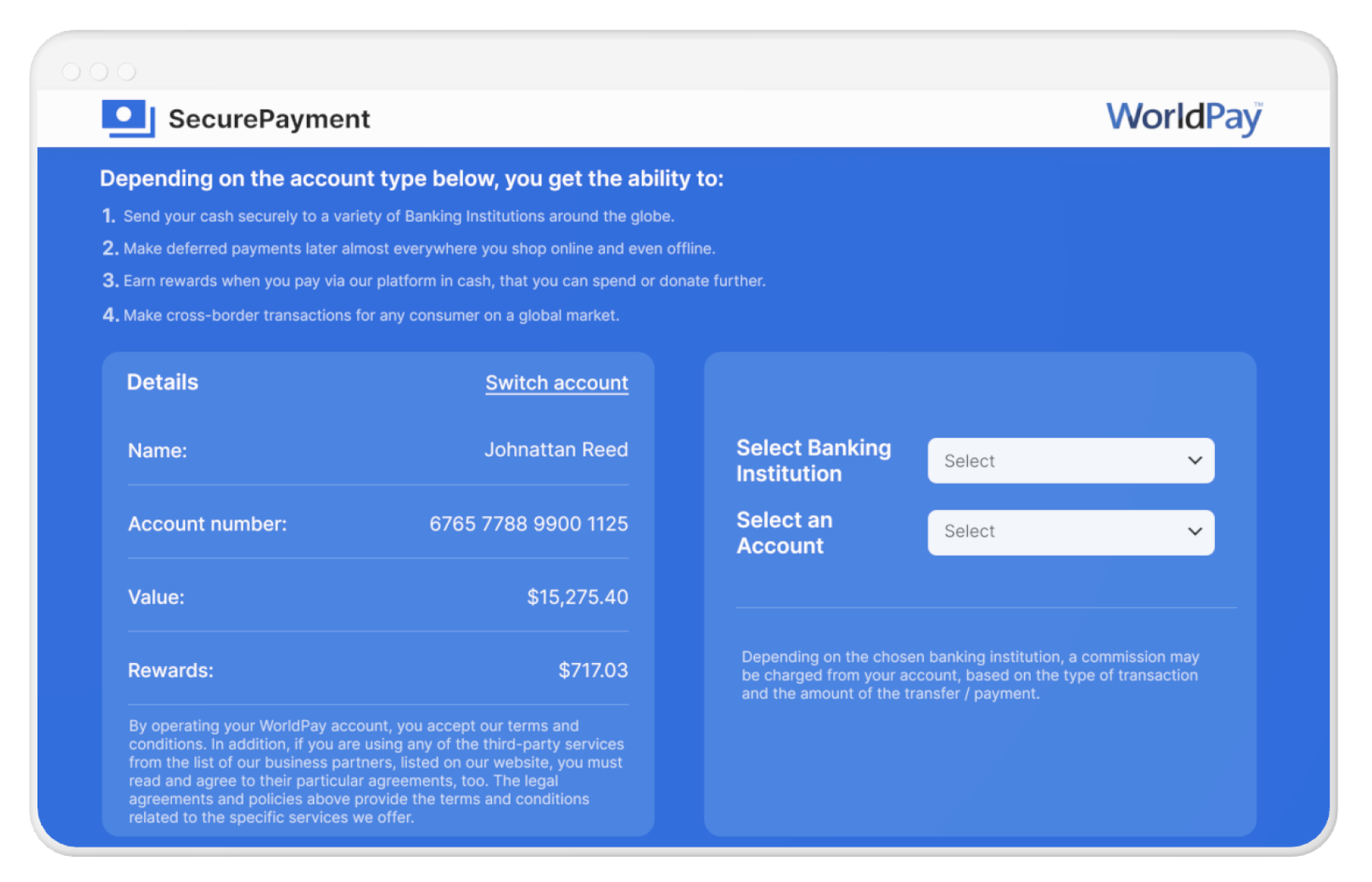

Our team enhanced a non-card payment solution and its architecture to assure a smooth integration of a new financial institution.

Client & Requirements

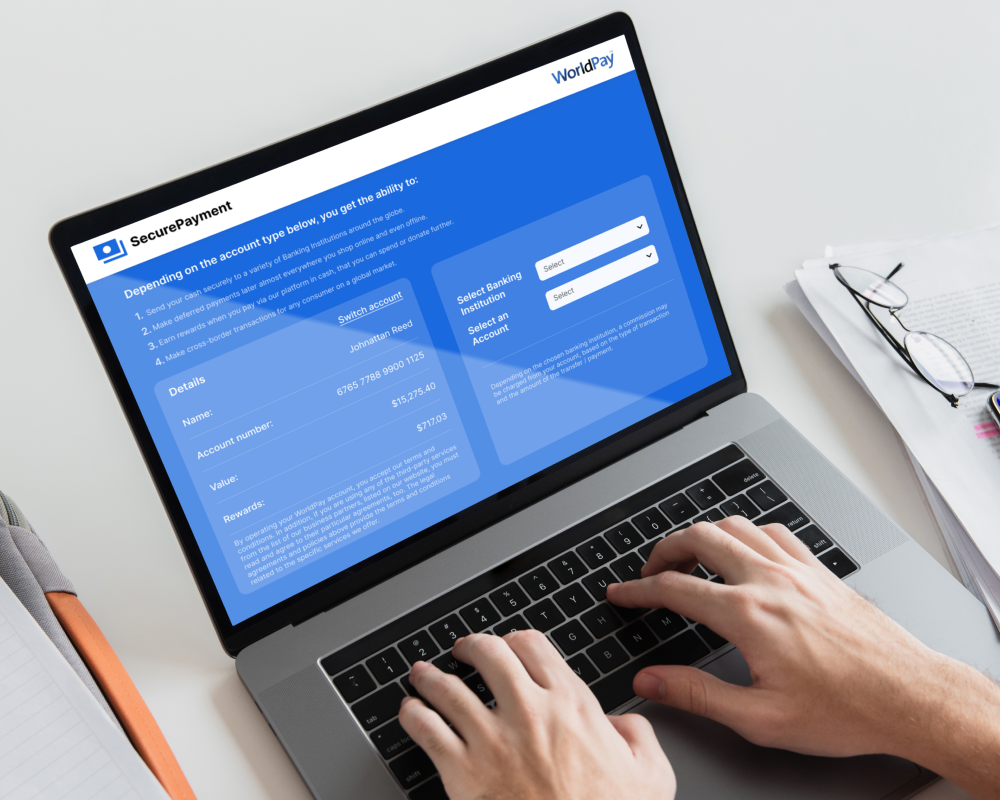

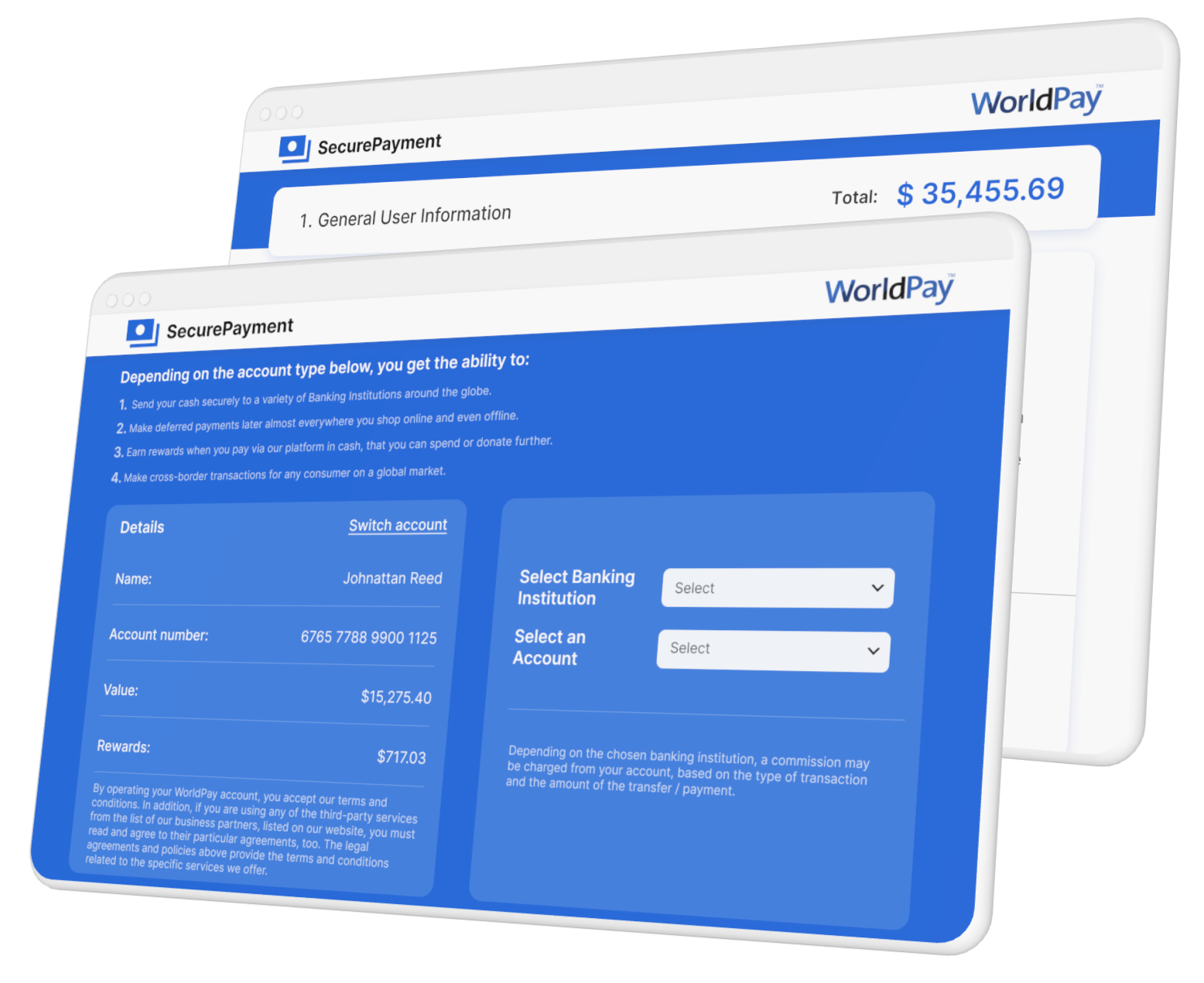

In this project, we collaborated with a US-based non-card payment system with the largest banking network organized well for making online cash payments, bank transfers, and cross-border transactions for every consumer on a global market.

The client reached our company to get several dedicated experts to develop and set up well-tailored infrastructure assuring failure-free integration of a new financial institution to their currently running e-payment system.

Challenges

Since the client hired specialists from Mbicycle while their project was already launched and operating with a large active client base, therefore, there were a few challenges that our team faced, as follows:

- Ensuring quick entry into the project and creating effective interaction with the rest of the team.

- Improving the existing user experience as well as overall app performance.

- Eliminating the risk of errors and crashes during transactions that may be caused by the software architecture.

- Assuring strong security when privacy data is shared with third parties.

- Reducing the time required for transferring money between financial institutes, including the time of authentication and waiting for confirmation.

Solution

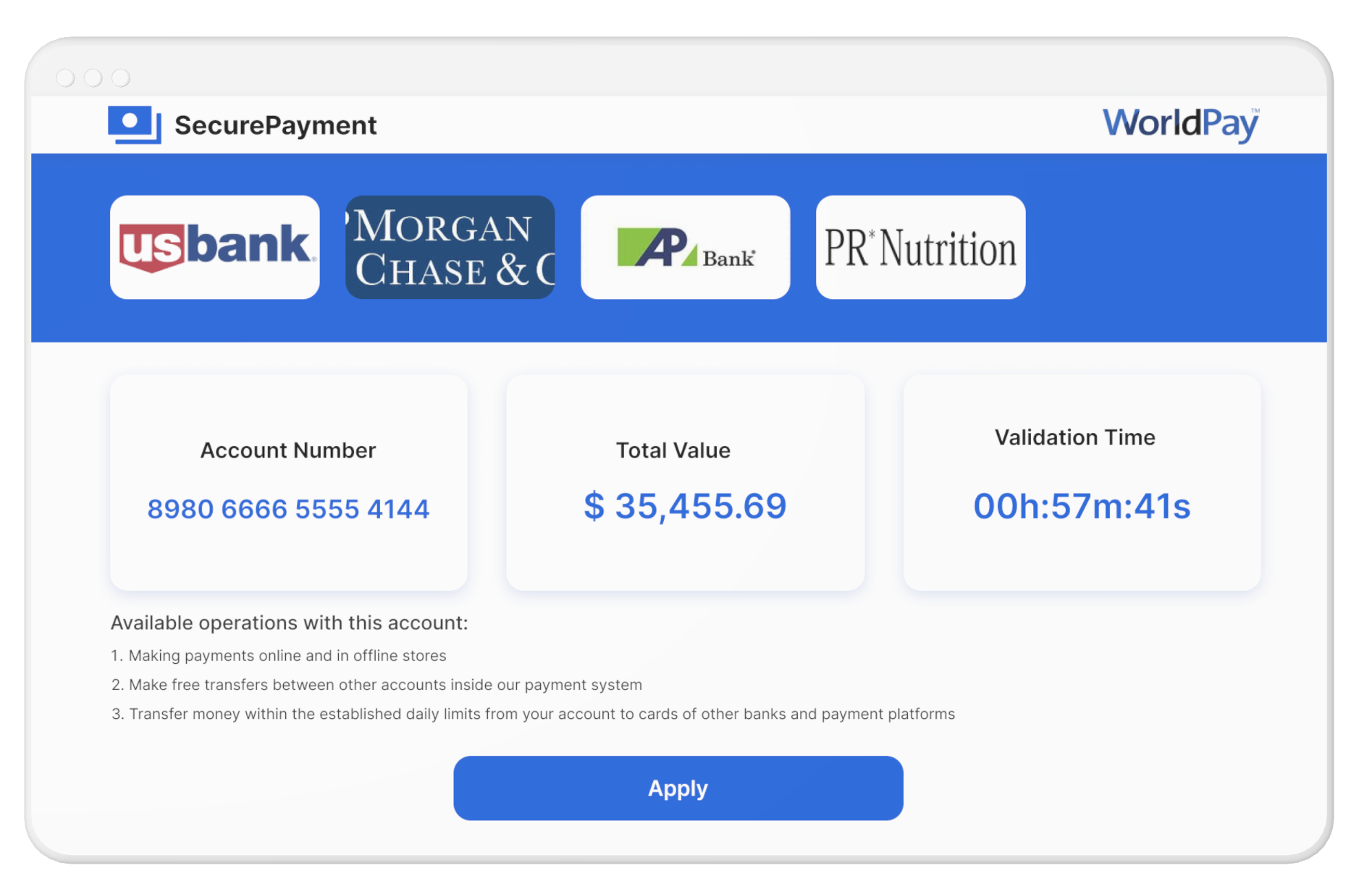

To fulfill the client’s requirements precisely, our team set out and implemented several features to improve and customize the project architecture to effectively and smoothly introduce a new resident bank into the system and connect it with the entire client base.

In addition to getting through the main task, the client entrusted us to improve the overall app performance and add a few features related to plugging a new resident bank into the client’s electronic payment system. To effectively meet all declared requirements, experts from Mbicycle completed the following steps:

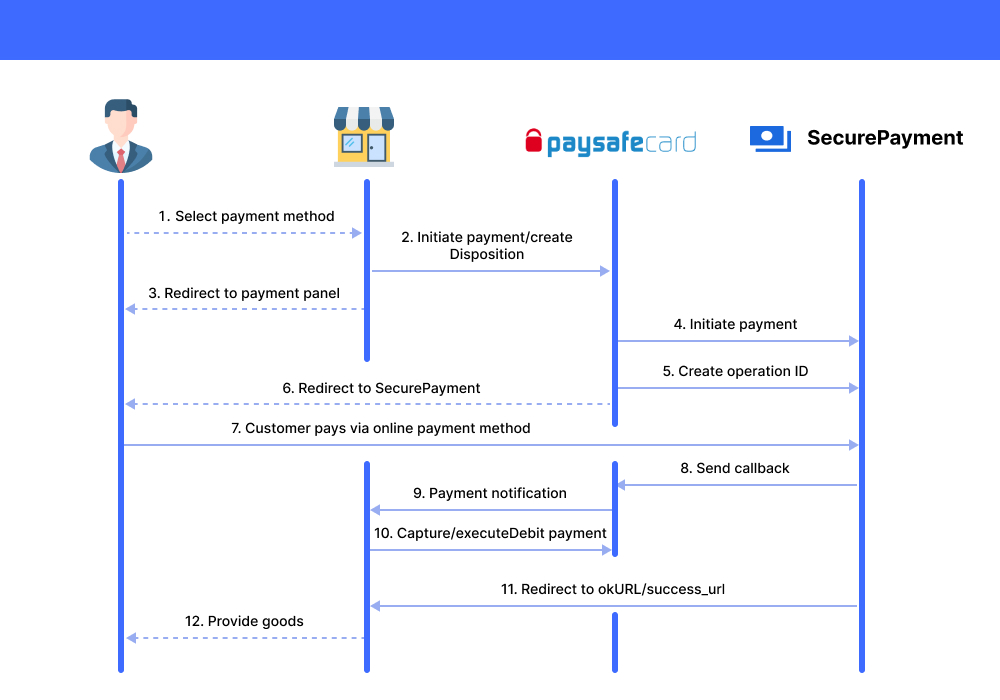

- Setting up the exchange of payment information between the new resident bank and the entire e-payment platform.

- Implementing the exchange of information on transferring payments between the new resident bank and the payment system in general.

- Developing and configuring all necessary infrastructure, including scheduling processes, sharing, transferring, and encryption files, as well as third-party APIs integration.

Process

To implement all the planned tasks efficiently, the Mbicycle dedicated team included two full-stack .NET developers and a QA engineer.

The project team on the client’s side included the following specialists:

- .NET TechLead

- 7 .NET developers

- Business Analyst

- 2 QA engineers

In this project, our dedicated team followed the Agile development methodology with two-week sprints. According to this model, we held daily meetings once a day with the client’s team, as well as meetups within our in-house team as required.

Technologies & Tools

Core tech

C#

Architecture

Microservice

Frontend

Angular, TypeScript

Database

MS SQL, Dapper

Third-party library APIs

.NET Core 6, Microsoft Azure

Results

As a result of cooperation with the client in this project, we have successfully developed and implemented all the planned features, needed for effective organization and integration of the new resident bank into the client’s large electronic payment system. Our team also helped significantly improve the user experience while working with the platform and reduce the processing time for each transaction.

The client was completely satisfied with the results as we set up all necessary infrastructure for another bank to join the platform and assured its smooth operation, which allowed to expand the overall number of app users and transactions. In the future, the client plans to involve our experts in case of adding new residents to their e-payment network, as well as expanding and improving the overall functionality of the app.