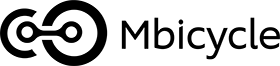

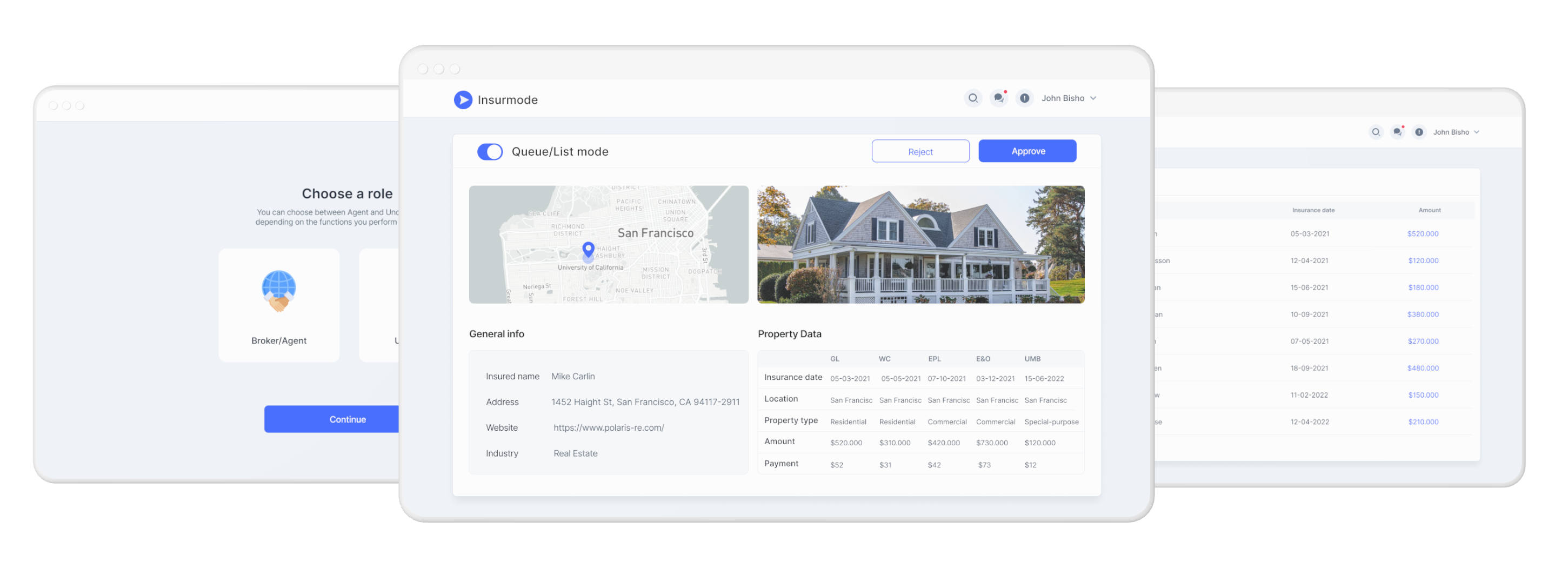

Insurance Broking Management Software

Our team has developed an insurance broking software for agents, brokers, and underwriters to collaborate on covering all-size risks & challenges.

Client & Context

In this project, we collaborated with a company that has been operating in the field of brokerage and management services for more than nineteen years and has a deep understanding of sales and underwriting processes, as well as strong marketing knowledge.

The client turned to our company due to a recommendation from our partner we’ve already cooperated before. They were looking for a reliable and skillful team that could refine and improve their insurance broking software. The client interviewed several specialists from Mbicycle, and eventually, they formed a development team from our specialists to work on their software. The main task for our company was to improve the client’s current website, which at that time had insufficient functionality, ran with lots of bugs, and didn’t meet the needs of their business.

Challenges & Requirements

The main requirement for our team was to create a convenient insurance broking management software tool that helps to collect and store information about the insured agents, who want to secure their property and get up-to-date information about this property from the underwriters via the client’s software.

The client required an application that will work effectively in the following business scenarios:

- Clients come to the Agent to insure their property, facilities, company employees, etc. The Agent fills out the client’s card with all the details required and also notes the cases and limitations that this insurance will cover. When all necessary data is filled, the Agent sends a request to the Underwriter.

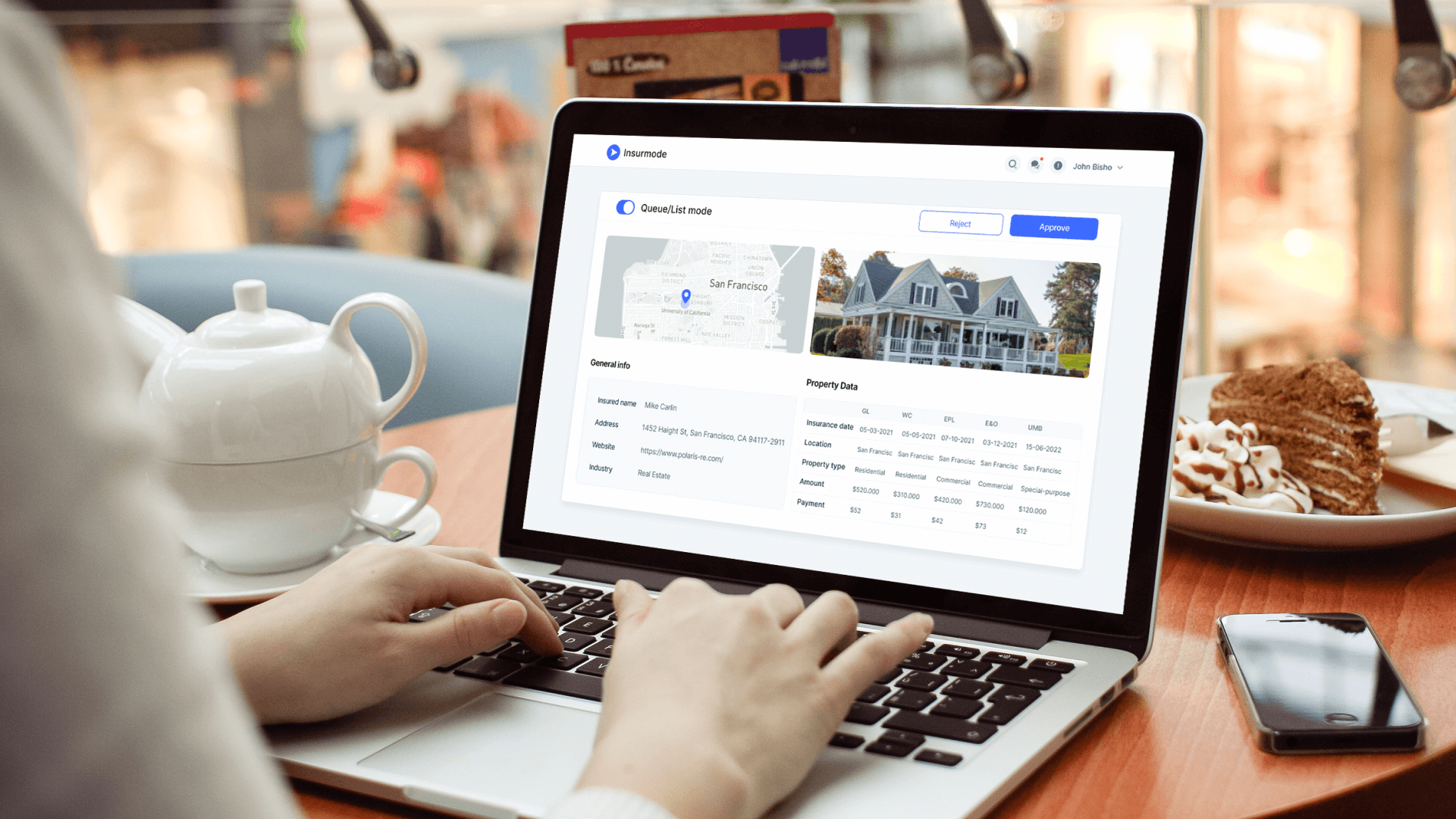

- The Underwriter, having received a request from the Agent, checks all the entered data about the client and makes a decision — to approve or reject this insurance request. With any decision of the Underwriter, the Agent gets a notification about its results.

The full challenge list for our team included the following:

- Perform code refactoring.

- Fix all current bugs and issues.

- Optimize the source code.

- Extend the functionality of the client’s current solution.

- Plug in a third-party service to improve the overall reliability and quality level of the insured’s verification.

- Redesign the UI/UX of the already existing features and develop from scratch the UI/UX of new functionality.

- Release MVP as soon as possible.

Process

The project team was fully formed from the specialists of our company and included a Front-end Developer, Business Analyst, and Project Manager. As this project was a startup, which often implies changing requirements during the working process, we decided to follow flexible development methodologies and chose Kanban as a basis.

We also held a discovery phase before the start. At this stage, we discussed all the shortcomings of the current solution and define the list of improvements. Based on its results, we compiled a feature matrix and described the basic acceptance criteria of this project. Every time our team completed the development of each new functionality, we uploaded it to the test server and notified the client about this update.

Once a week we held an online meeting to discuss the current status of the project and get feedback from the client. We implemented the MVP a month and a half after the project started.

Solution

Based on the client’s stated requirements, experts from Mbicycle refactored and optimized the code, as well as developed and implemented a list of the following features:

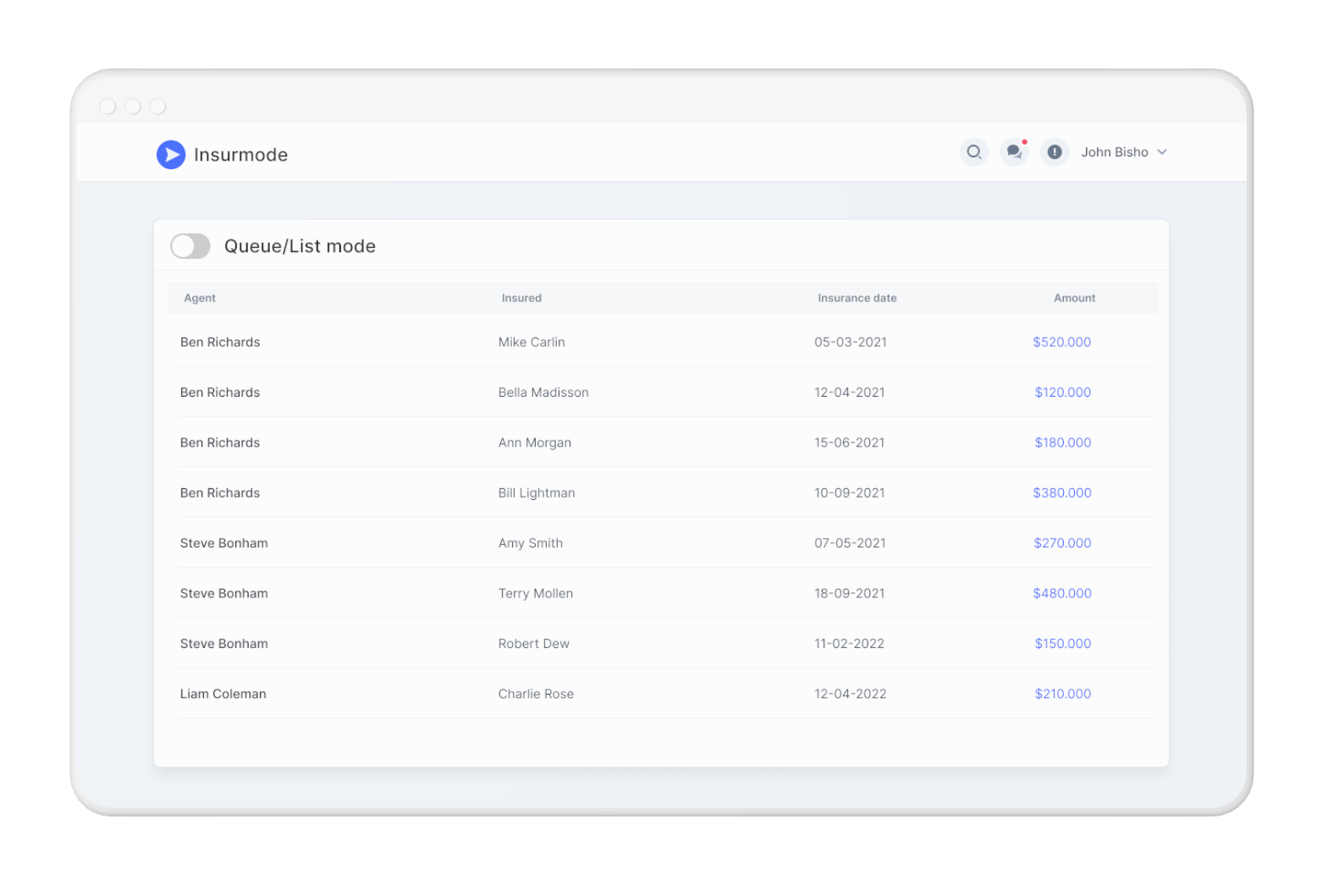

- Convenient sign-up via e-mail with an option to choose a role right away.

- A large variety of inputs, checkboxes, and radio buttons for the Agent’s convenience when they gather the information. We have also optimized the number of fields with custom information to speed up the process of filling out and submitting the request for the Underwriter.

- A feature for Agents — a quick search of a currently free Underwriter.

- Integration with a third-party service, Equifax, which provides additional information on each insured client, if necessary.

- A function for Underwriters — a dashboard of requests and convenient access to the specific service for checking the insured user.

- Updates of the request status in real-time and a notification for a client with the results.

- MVP for the web version of the insurance underwriting marketplace.

Technologies & Tools

Frontend

VueJS, Bootstrap

Backend

PHP

Database

MongoDB

Third-party library APIs

Laravel framework

Results

We completed the work on this insurance broking software within the stated time frames and estimates and considered all the client’s requirements. At the moment, the client is pitching their project using our delivered MVP to find potential investors, as well as offering their solution to small brokerage firms.

After getting the required amount of investment, the client plans to implement a mobile version of their app and extend its existing functionality with the involvement of a development team from Mbicycle.